As an extension of my prior articles about AI Models and Use Cases I am digging up here into the AI Value Chain; to best understand who benefits the most from the development, deployment and adoption of AI across industries.

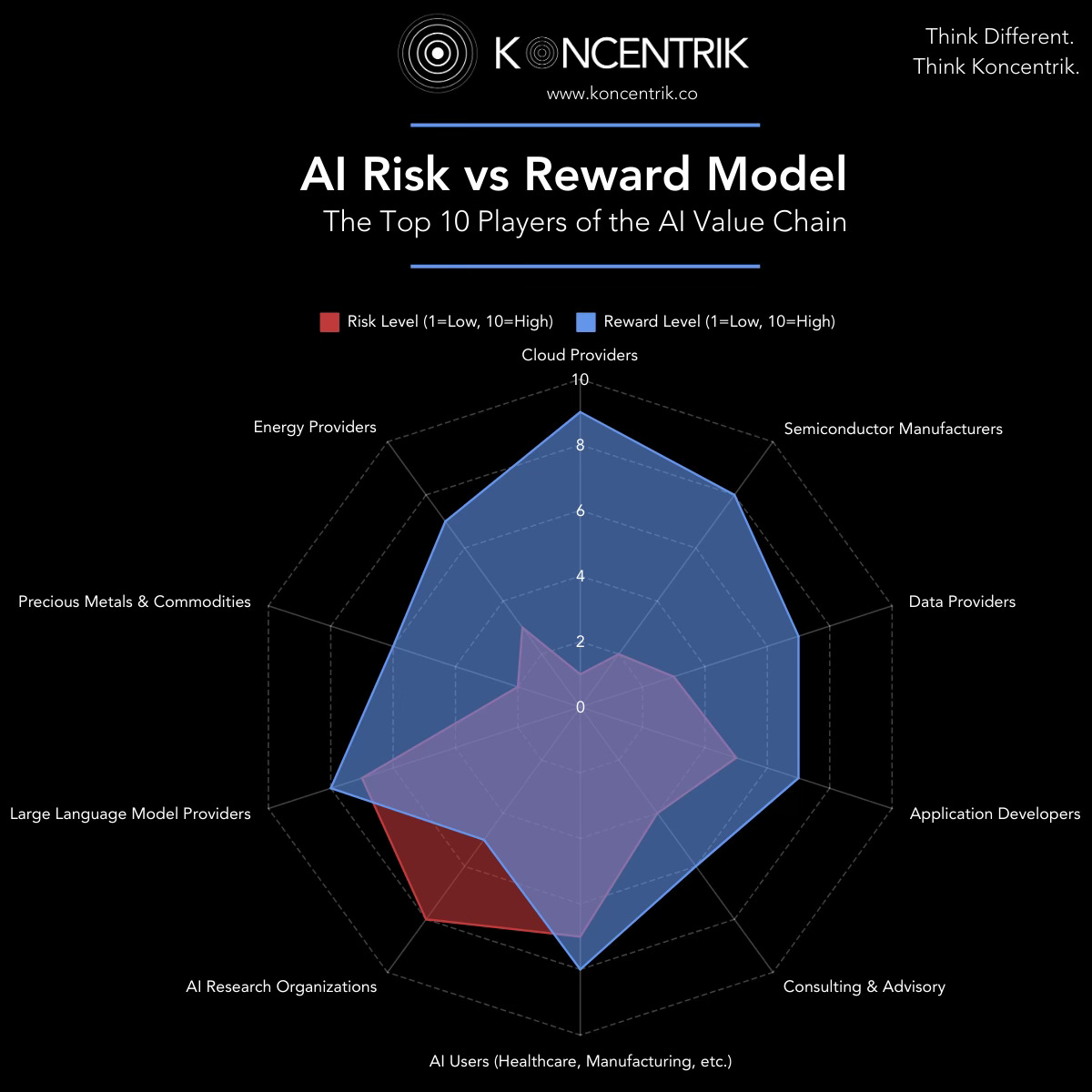

Clearly, there are very different risks and rewards profile for each players, which I am dissecting here.

The AI Value Chain: Analyzing Risks, Rewards, and Market Potential of Key Industry Players

Artificial Intelligence (AI) has become a cornerstone of innovation, driving transformation across industries by improving efficiency, fostering creativity, and opening new opportunities. However, the AI ecosystem is complex, with various players contributing uniquely to its success.

This article explores the 10 key players within the AI value chain, examining their roles, risks, rewards, and market potential to provide a clear understanding of the dynamics at play.

First a note below about my methodology to come up with the ratings.

AI Risk / Reward Model: Explained

My analysis of the AI value chain adopts the following methodology to assign risk and reward ratings:

Risk Level (Scale 1 to 10):

• Low Risk (1-3): Stable industries with consistent demand and minimal external pressures.

• Medium Risk (4-6): Industries exposed to market competition, regulatory concerns, or product uncertainties.

• High Risk (7-10): Businesses with significant investment requirements, dependency on market factors, or emerging technologies.

Risk explanations were determined based on:

• Business dependencies (e.g., supply chains, customers).

• Capital intensity and innovation requirements.

• Regulatory and geopolitical risks.

Reward Level (Scale 1 to 10):

• Low Reward (1-3): Limited or niche market opportunities with slower growth trajectories.

• Medium Reward (4-6): Moderate growth potential driven by stable market trends.

• High Reward (7-10): Industries poised for transformative growth, scalability, and profitability.

Reward explanations consider:

• Industry growth trends.

• Revenue scalability and recurring income potential.

• Alignment with AI market expansion.

Below are the risk / reward profile for each of the 10 players identified along the AI value chain.

Feel free to download, share and post, please do mention the source (www.koncentrik.co)

1. Cloud Providers: The Backbone of AI Infrastructure

Cloud providers are essential enablers of the AI ecosystem, offering scalable compute and storage solutions that power AI workloads. As AI adoption accelerates, the demand for cloud services continues to grow, placing providers like AWS, Google Cloud, and Microsoft Azure at the center of the AI value chain.

Their business models are highly resilient, relying on subscription-based revenue streams, making their risk profile exceptionally low. However, the rewards are immense, with cloud providers benefiting from global AI workloads and significant scalability potential.

The market size for cloud services is vast, with its growth driven by organizations of all sizes adopting AI technologies, ensuring a strong and sustainable future for this industry.

2. Semiconductor Manufacturers: Powering the AI Revolution

Semiconductor manufacturers play a pivotal role in AI by producing the GPUs, TPUs, and AI accelerators required for AI computations. These companies, such as NVIDIA, AMD, and TSMC, are the technological backbone of AI hardware.

Despite their strong market position, they face moderate risks, including supply chain vulnerabilities and geopolitical tensions. However, the rewards are substantial, as the demand for AI-specific chips continues to surge, driven by the rapid growth of AI applications.

The semiconductor market is expansive, not only serving AI but also supporting other industries, making it one of the most critical and high-potential sectors in the AI value chain.

3. Data Providers: The Lifeblood of AI Development

Data providers supply the critical datasets that fuel AI model training and analytics. Companies like Snowflake, Palantir, and LexisNexis are indispensable to the AI ecosystem, enabling the creation of accurate and effective AI solutions.

While their business models face moderate risks, such as data privacy regulations and intense competition, their revenue streams remain stable due to the recurring demand for high-quality data. The rewards for data providers are significant, as the need for both structured and unstructured data grows across industries.

As AI adoption expands, data providers are positioned to capitalize on this growth, with a steadily increasing market size.

4. Application Developers: Innovators at the Frontline of AI

Application developers create AI-powered software solutions tailored to specific business needs, spanning industries from healthcare to retail. This sector is characterized by high levels of innovation, with companies like Salesforce, Adobe, and UiPath leading the charge.

However, these businesses face medium risk levels due to challenges in achieving product-market fit and differentiating their offerings in a competitive market. Despite these challenges, the rewards can be substantial. Successful applications have the potential to scale rapidly and generate significant revenue.

The market for AI applications is growing steadily, with increasing demand from enterprises seeking to optimize operations and enhance customer experiences.

5. Consulting & Advisory Firms: Guiding AI Adoption

Consulting and advisory firms play a crucial role in the AI ecosystem by helping organizations navigate the complexities of AI adoption.

Companies like McKinsey, BCG, and Accenture provide strategic guidance and technical expertise, ensuring businesses can leverage AI effectively. While the risks for these firms are relatively low, their growth is tied to the overall pace of AI adoption across industries. The rewards, though moderate, are stable, with consistent demand for their services.

The market for consulting and advisory in AI is solid but lacks the scalability of product-based industries, making it a steady but less transformative sector in the value chain.

6. AI Users: The Risk Takers in the Ecosystem

AI users, including industries like healthcare, manufacturing, and finance, are at the forefront of applying AI technologies to improve operations, reduce costs, and gain competitive advantages.

These companies face some of the highest risks in the AI value chain due to significant upfront investments, compliance challenges (especially in regulated industries like healthcare), and uncertainty around returns. However, the potential rewards are equally high. AI promises transformative efficiency gains, improved decision-making, and new revenue streams.

While the market potential for AI users is vast, it depends heavily on successful implementation and measurable ROI, making this category both exciting and challenging.

7. AI Research Organizations: Innovating for the Future

AI research organizations, such as OpenAI and Google DeepMind, drive foundational advancements in AI technologies. These entities often operate at the cutting edge of innovation, partnering with enterprises to bring theoretical concepts into practical applications.

However, their high risk profile stems from the substantial costs of R&D and the uncertainty of monetization. Despite these challenges, their work underpins much of the AI industry, creating moderate rewards through partnerships and intellectual property licensing.

The market for AI research remains niche, primarily focused on collaborations with industry leaders and academia.

8. Large Language Model Providers: Transforming AI Communication

Large language model providers like OpenAI (GPT) and Meta (LLaMA) have become key players in the AI landscape, developing advanced AI models that revolutionize natural language processing.

These companies face high risks due to the immense computational costs of training and maintaining their models and the challenge of monetizing their offerings effectively. However, the rewards are significant, as these models have immense scalability potential and wide-ranging applications across industries.

The market for large language models is growing rapidly, driven by increasing enterprise adoption and consumer interest in AI-powered communication tools.

9. Precious Metals & Commodities: The Essential Inputs

The AI hardware industry relies heavily on precious metals and commodities like silicon and rare earth elements. Suppliers in this category play an essential role by providing the raw materials needed for semiconductor manufacturing and other hardware components.

While their risk levels are low, given the stable demand for these materials, geopolitical issues and supply chain disruptions remain potential concerns. The rewards are moderate, as these materials are critical to the production of AI hardware.

The market size is steady and closely linked to the growth of the semiconductor industry.

10. Energy Providers: Powering the AI Revolution

Energy providers are increasingly integral to the AI ecosystem, supplying the power needed to run data centers and AI infrastructure. As AI workloads continue to grow, so does the energy demand, creating significant opportunities for providers. See Microsoft deal with Three Mile Island nuclear facility a few months ago.

These companies face moderate risks, including environmental regulations and dependency on evolving energy trends. However, the rewards are substantial, with rising AI adoption driving consistent growth in energy consumption.

The market size for energy providers is robust, supported by the expanding AI and cloud infrastructure sectors.

Conclusion

The AI value chain is a diverse and dynamic ecosystem, with each player contributing uniquely to its growth.

From cloud providers and semiconductor manufacturers to end-users and energy providers, every segment plays a critical role in shaping the future of AI.

By understanding the risks, rewards, and market potential of these industries, businesses and investors can navigate the complexities of the AI landscape and unlock its transformative potential.

It gets me to think though… dig for gold? or sell shovels…?

thanks for reading!