Smart Cities: The Singapore Way – Successes, Challenges and Learnings

How innovation, data, technology and policies can drive change and progress on a national scale.

A few weeks ago, I was incredibility lucky to be invited by Mayor Lee Dong-Hwan of Goyang Special City, South Korea to share about Smart Cities development as part of their annual World Cities Forum.

I had stopped over Seoul many times before while I was ‘commuting’ from Toronto, Canada to Singapore for almost 3 years; but had never left the airport!

Visiting South Korea for the first time was eye opening: I was truly impressed by its incredibly modern infrastructure and fast growing economy, iconic home grown companies and its approach to tackle the challenges ahead, in particular: a shrinking population, a slowing growth, geopolitics and climate change.

Although not a Singaporean myself, I tried my best to give a glimpse of Singapore’s own journey, its successes, unique imperatives as a nation and learnings over the past 60 years.

Here is a short 2 min video summary:

Executive Summary

For policy makers, city and government officials, technologists, citizens around the world who are interested to get a unique perspective about how innovation, data, technology and policies can drive change and progress on a national scale.

Below is my extensive yet imperfect attempt to describe what I have seen, experienced and contributed to in the past 10 years.

1. Singapore’s Unprecedented Growth: A Case Study in Intentional Innovation

Over 60 years, Singapore transformed from a low-income nation to a global hub for trade, finance, and innovation, driven by a deliberate, long-term strategy. Policies like export-driven industrialization, education investment, and efficient governance enabled rapid GDP growth, world-class infrastructure, and global competitiveness. This growth underscores the power of coordinated public-private partnerships in fostering prosperity.

2. Smart Nation: Beyond the Smart City Paradigm

Singapore’s Smart Nation Initiative integrates technology across societal, governmental, and economic domains. Innovations like contactless payments, real-time transport systems, and smart estate management exemplify how data and IoT improve daily life. However, Singapore’s unique centralized governance allows nation-scale execution, a model hard to replicate elsewhere.

3. Unique Imperatives: Innovating from Constraints

Singapore’s geographical and resource limitations—scarce land, limited water, and reliance on imports—necessitated innovation for survival. Initiatives like water self-sufficiency (NEWater, desalination) and urban farming (30 by 30 plan) highlight how necessity can drive sustainable, transformative policies that align with national resilience goals.

4. The Price of Progress: Inequality and Ethical Dilemmas

While technological advancements and economic growth have improved quality of life, challenges remain. Wealth inequality, digital divides, and concerns over data privacy and surveillance have exposed gaps in inclusivity. These issues stress the need for ethical frameworks that prioritize equitable benefits and transparency in data use.

5. Lessons for Global Cities: Adaptation, Not Replication

Singapore’s success stems from its unique context—centralized governance, strategic location, and necessity-driven innovation. Cities aiming to emulate its model must adapt strategies to local conditions, emphasizing inclusivity, sustainability, and human-centric design. The focus should be on fostering collaboration between governments, private sectors, and communities while respecting cultural and socio-political realities.

Singapore’s approach underscores that innovation at a national scale is a blend of visionary leadership, intentional policymaking, and leveraging technology as a tool—not a solution—for progress.

Let’s now deep dive into Singapore’s incredible journey…

Introduction

I am sharing here my own views as a 10 year resident, a technologist in IoT, Robotics, Data & AI, an entrepreneur and business owner; both as an observer and an active and humble contributor to Singapore’s Smart Nation agenda including several exciting initiatives I was extremely lucky to be part of; to name a few:

Contactless & digital payments solutions for SMEs as CTO at PayNear (formerly GoSwiff)

Creating contactless gifting experiences with eVouchers and programmable money as fractional CTO at Uniqgift

Financial planning for all using robot advisory as Tech Advisor for NTUC Enterprise and Money Owl

Equity risk intelligence for institutional investors using big data and AI as Head of Products at BlueFire AI

Making healthcare more efficient using robotics, computer vision and IoT as Head of Open Innovation at NCS Group

Smart estates energy conservation and preventative maintenance using IoT and AI as Head of Open Innovation at NCS Group

Automated last mile delivery via autonomous robots as Head of Open Innovation at NCS Group

Creating more inclusive art experiences using immersive tech and generative AI as Head of Open Innovation at NCS Group

Retail Excellence & Automation using mobile, computer vision and generative AI as Founder and CEO at StoreWise AI

I wrote a few related articles you might find useful here: Making Investment Decisions Using Big Data & Machine Intelligence, Augmenting Humans With Technology, FinTech 90% Hype vs 10% Revolution, Banks & Startups Collaboration: In the Search of Equilibrium for Sustainable Growth, Innovation Needs Convictions.

Foreword

In 1957, Mr Lee Kuan Yew, had said that the idea of an independent Singapore was a “political, economic, and geographical absurdity”.

Mr Lee Kuan Yew became the country’s first prime minister in 1959 and served as Prime Minister for 31 years, from 1959 to 1990, making him one of the longest-serving prime ministers in history. After stepping down, he continued to influence Singapore’s development as a Senior Minister and later as Minister Mentor until 2011.

In the past 60 years since its inception as an independent nation, Singapore has seen unprecedented growth.

Today, Singapore is seen by many leaders globally as a model of development, prosperity and growth.

What has been achieved? What policies have shaped its growth? How has technology and data become ubiquitous in Singaporeans daily lives? How do they help (or not) Singaporeans today? What is unique to this city-state and can its success be exported to other cities or countries? Has everyone benefited from such impressive growth the same way ? Who has been left behind? What are the challenges coming ahead for Singapore and its leaders?

In this article, I will attempt to shade some lights on the above questions and go through three important aspects:

• 60 years of unprecedented growth

• Singapore’s Unique Imperative as a Nation

• The price of progress

We will focus what was achieved (the results), how it was done (policies, strategy, execution) and the why (constraints) and explore why although many leaders have been wanting to ‘copy’ the Singapore model; it is quite hard for them to do.

60 years of unprecedented growth

From economic reforms to embracing technology, here are some examples on how government policies and public-private partnerships have fostered innovation, leading to efficient public services and a robust digital infrastructure. By no means it’s meant to be exhaustive but rather illustrations of what prosperity looks like today.

In Rankings

Here is a long (non-exhaustive nevertheless impressive) list of areas where Singapore ranks 1st regularly, from infrastructure to economy and trade:

Skytrax World’s Best Airport Ranking: Changi Airport in Singapore consistently ranks 1st or 2nd due to its world-class facilities, passenger experience, and innovative services. Source: Skytrax World’s Best Airport

World’s Best Container Port (Lloyd’s List): The Port of Singapore frequently ranks 1st or 2nd as one of the busiest and most efficient container ports, handling vast volumes of shipping traffic. Source: Lloyd’s List

World’s Best Airline (Skytrax): Singapore Airlines is consistently ranked in the top 3 for its exceptional service, safety, and premium cabin experience. Source: Skytrax World’s Best Airline

Asia’s Most Liveable City (Mercer Quality of Living Survey): Singapore ranks 1st as the most liveable city in Asia, known for its safety, infrastructure, healthcare, and quality of life. Source: Mercer Quality of Living

Foreign Trade and Investment (IMD World Competitiveness Yearbook): Singapore ranks 1st for foreign trade and investment, reflecting its status as a global financial hub with pro-investment policies. Source: IMD World Competitiveness Yearbook

Best Performing Healthcare System (Bloomberg Health Efficiency Index): Singapore consistently ranks 1st for its efficient healthcare system, delivering excellent outcomes at relatively low costs. Source: Bloomberg Health Efficiency Index

Ease of Doing Business (World Bank): Singapore ranks 1st or 2nd as the easiest place to do business, due to its transparent regulatory framework and supportive policies. Source: World Bank Doing Business

Best Passport to Travel (Henley Passport Index): The Singapore passport offers access to 192 countries without a visa or with a visa on arrival, making it the world’s most travel-friendly passport. Source: Henley Passport Index

In Numbers

Singapore growth in numbers:

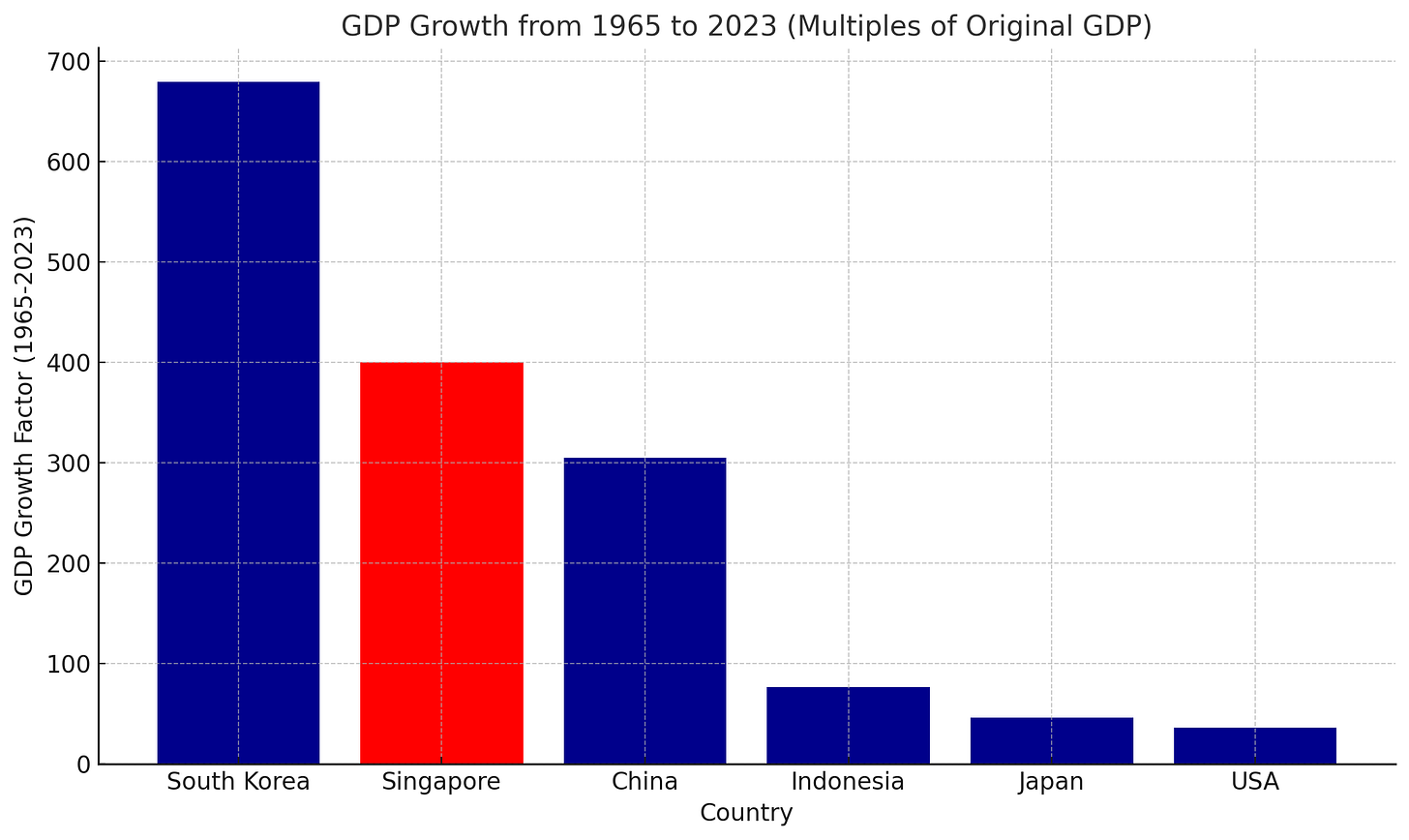

• Rapid GDP Growth: Singapore’s 400-fold GDP growth from US$970 million in 1965 to US$423 billion in 2023, driven by trade, finance, and industrialization. From 1965 to 2023, Singapore’s GDP grew at an average annual rate of around 7-8%, making it one of the fastest-growing economies in the world during that period. For comparison it has outpaced Indonesia’s (77-fold), China’s (300-fold), Japan’s (46-fold), the USA’s (36-fold). Sources: World Bank Singapore, World Bank South Korea, World Bank USA, World Bank Indonesia, World Bank Japan.

Transformation into a Global Trade Hub: Singapore became one of the world’s busiest ports, with its strategic location turning it into a global trade and financial center. Singapore is the world’s second-largest container port, handling around 37.5 million TEUs (Twenty-foot Equivalent Units) in 2022.

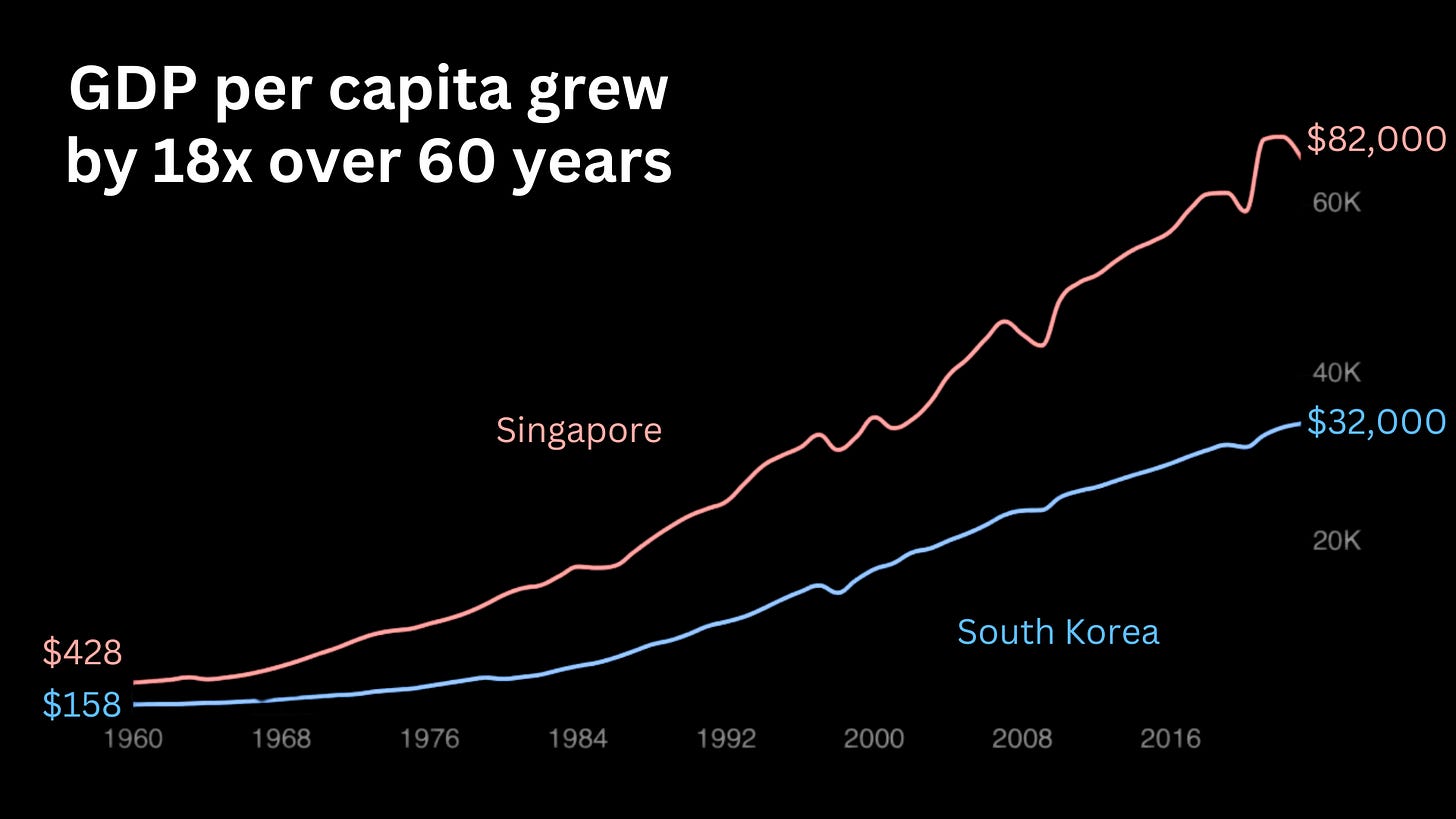

High Standards of Living: Singapore transformed from a low-income country to one of the highest per capita income countries in the world. In 1965, Singapore’s GDP per capita was just over USD 500, but by 2023 it exceeded USD 80,000 (and 18x growth!), ranking it among the top 10 globally. Source: World Bank.

Low Unemployment and Economic Resilience: Singapore has consistently maintained low unemployment rates, even during global economic downturns. As of 2023, Singapore’s unemployment rate hovers around 2-3%, even after the global economic disruptions caused by COVID-19.

Diversified and High-Value Economy: Singapore has successfully diversified its economy, moving from manufacturing to becoming a leader in finance, biotech, and technology innovation. The financial services sector contributes about 13-14% to Singapore’s GDP, with the country being one of the leading financial centers in Asia.

For more socio-economic data about Singapore please refer to this link.

Now, what’s behind these numbers? How were they achieved? What policies have helped shape this growth?

Six Policies That Have Shaped Singapore’s Growth

I am listing here six policies which I believe have heavily contributed to:

attracting AND retaining capital

enabling social stability and prosperity via wealth distribution

#1. Economic Development and Industrial Policy: Singapore pursued an export-oriented industrialization strategy that attracted foreign direct investment (FDI) and positioned the country as a global manufacturing and financial hub. The establishment of Jurong Industrial Estate in the 1960s was pivotal in attracting multinational corporations (MNCs). The Economic Development Board (EDB) provided various incentives such as tax exemptions, grants, and infrastructure support to attract foreign businesses. By attracting global companies to set up operations in Singapore, the government transformed the country from a low-income economy reliant on entrepôt trade to a high-tech manufacturing and services powerhouse. Today, Singapore is home to many regional headquarters for MNCs (more on that later).

#2. Focus on Education and Human Capital Development: The government invested heavily in education, focusing on building a technically skilled and adaptable workforce capable of meeting the needs of an evolving economy. Programs such as SkillsFuture encourage lifelong learning, while the development of Polytechnics and the Institute of Technical Education (ITE) help cultivate industry-specific skills. The emphasis is on STEM (Science, Technology, Engineering, Mathematics) education and applied learning. Singapore’s workforce is among the most skilled in the world. The World Bank ranks Singapore’s human capital among the top globally, and its education system is frequently ranked highly in the Programme for International Student Assessment (PISA) studies. This strong human capital base has made Singapore attractive to tech and finance industries.

#3. Efficient Governance and Anti-Corruption Framework: Singapore has implemented zero-tolerance for corruption, combined with transparent, highly efficient governance. The creation of the Corrupt Practices Investigation Bureau (CPIB) in 1952 provided an independent body to investigate and act on corruption cases. Strict laws ensure that public officers and private sector players remain accountable. Singapore consistently ranks among the least corrupt countries globally, according to Transparency International. Its clean governance system has been a key driver in attracting foreign investment, ensuring a stable and predictable business environment, and maintaining public trust in institutions.

#4. Central Provident Fund (CPF) and Social Security Policy: Singapore’s Central Provident Fund (CPF) system is a mandatory social security savings scheme designed to provide financial security for its citizens in retirement, healthcare, and housing. The CPF scheme, implemented in 1955, requires both employees and employers to contribute a portion of wages to an individual savings account. Over time, the CPF expanded to cover housing and healthcare needs, allowing Singaporeans to use their CPF savings for property purchases and medical expenses. The CPF has provided Singaporeans with a secure and well-managed savings system that has enabled high homeownership rates, ensured access to quality healthcare, and built a financially stable population. This policy helped create a stable society, reduce inequality, and maintain public confidence in long-term social security.

#5. Housing and Urban Development Policy: Through the Housing Development Board (HDB), the government provided affordable public housing, allowing citizens to benefit from Singapore’s economic growth. The HDB was established in 1960 to provide subsidized public housing to ensure that all Singaporeans had access to affordable, high-quality living conditions. Over 80% of Singapore’s population today lives in HDB flats, with schemes like Central Provident Fund (CPF) allowing citizens to use retirement savings for home purchases. This policy not only solved Singapore’s housing crisis but also fostered social stability and a sense of ownership. Singaporeans now have some of the highest home ownership rates in the world (around 90%), which has contributed to a stable society and helped avoid slums or urban decay.

#6. Strong Infrastructure and Connectivity Development: Singapore prioritized building world-class infrastructure and connectivity to facilitate global trade and become a critical node in the global economy. Investments in Changi Airport, recognized as one of the best airports globally, and the development of the Port of Singapore as one of the busiest container ports in the world have been key strategies as mentioned above. The expansion of submarine cable networks and high-speed broadband has made Singapore a digital and logistics hub (more on that later). Singapore’s strategic investments in infrastructure have made it a global leader in logistics, transportation, and digital connectivity. The World Bank ranks Singapore as one of the top-performing countries in terms of logistics and ease of doing business. Its global connectivity via air, sea, and digital channels has attracted businesses and trade, making it a major regional and international hub.

Other Major Policies Worth Highlighting:

Population and Immigration Policies: Singapore has actively managed its immigration policies to maintain a steady influx of both non-skilled and skilled foreign talent to complement its domestic workforce. This has helped to sustain growth in sectors like construction, technology, finance, and manufacturing.

Innovation and R&D Policies: The Singaporean government has emphasized research and development (R&D) through initiatives like Research, Innovation, and Enterprise (RIE) plans. The government allocates significant funds (around 1% of GDP annually) to support innovation in areas like biotech, digital technology, and smart cities.

In The Race for Digitization

Beyond these policies, an important plan was elaborated to help digitize Singapore: the Singapore Smart Nation Initiative was launched in 2014 by Prime Minister Lee Hsien Loong; and now revised as Smart Nation 2.0 (as of October 2024) by Prime Minister Lawrence Wong. It’s an articulation of a comprehensive strategy aiming to harness technology, data, and digital innovation to improve the quality of life for citizens, enhance business productivity, and create opportunities for Singaporeans in a rapidly evolving digital landscape.

It includes four dimensions: Digital Society, Digital Economy, Digital Government and Digital Security.

A few examples below on how these have translated into the day to day life:

Contactless payments: Cash at food stalls and small retail outlets was still king until late 2016… PayNow, launched in July 2017, as Singapore’s real-time funds transfer service, allowing instant transfers using QR code or mobile or National ID (NRIC/FIN) numbers. It saw rapid adoption, with 1.4 million registrations in its first year, doubling to 2.8 million by 2018. The introduction of PayNow Corporate in 2019 further expanded its use, with 4 million users by that year. The COVID-19 pandemic in 2020 accelerated digital payments, driving usage to 6.2 million users by mid-2020, with transaction volumes growing over 200%. By 2022, over 80% of Singapore’s population was using PayNow for personal, business, and government transactions. Today 95% of Businesses accept PayNow; it’s low cost and easy deployment has converted SMEs into accepting digital payments rapidly.

According to a recent report by Xero from August 2024, “currently, over three-quarters of Singapore consumers (76%) use credit or debit cards for payments. More than half of the population utilizes funds transfer service PayNow (55%) or bank transfers (55%). About a fifth are also using e-wallet service GrabPay (22%) and buy now, pay later platforms (21%)”.

Smart Transport: In Singapore, approximately 12% of the total land area is taken up by roads. Given Singapore’s limited land availability, the government has focused on efficient land use and transportation planning, leading to a balance between road infrastructure and other land uses. The lack of space has led to stringent congestion control measures and car ownership regulation. The cost of owning a car in Singapore is considered the most expensive in the world! It is more than the cost of the car itself due to the 10-year certificate of entitlement (COE) which can be as much as $116,000 SGD ($88,000 USD). For example, a Toyota Camry Hybrid costs around S$200,000 in Singapore, which is about six times more expensive than in the US! Still, as of August 2024, there were 855,454 registered vehicles in Singapore; as of 2023 (source).

As such, Singapore has been promoting the development of dense, modern and efficient public transport system made of underground trains, light rail and buses; with the ambition to create a 45-minute city and 20-minute towns by 2040, as per the Land Transport Authority Master Plan. Additionally, it regulates the traffic of motor vehicles using an Electronic Road Price (ERP) system, now moving into a new generation of gantry-less system, using Global navigation satellite system (GNSS); which will allow transport authorities to enable dynamic pricing (distance, time, day, car type, etc) to have more granular control on the traffic and shape new behaviours to limit congestion.

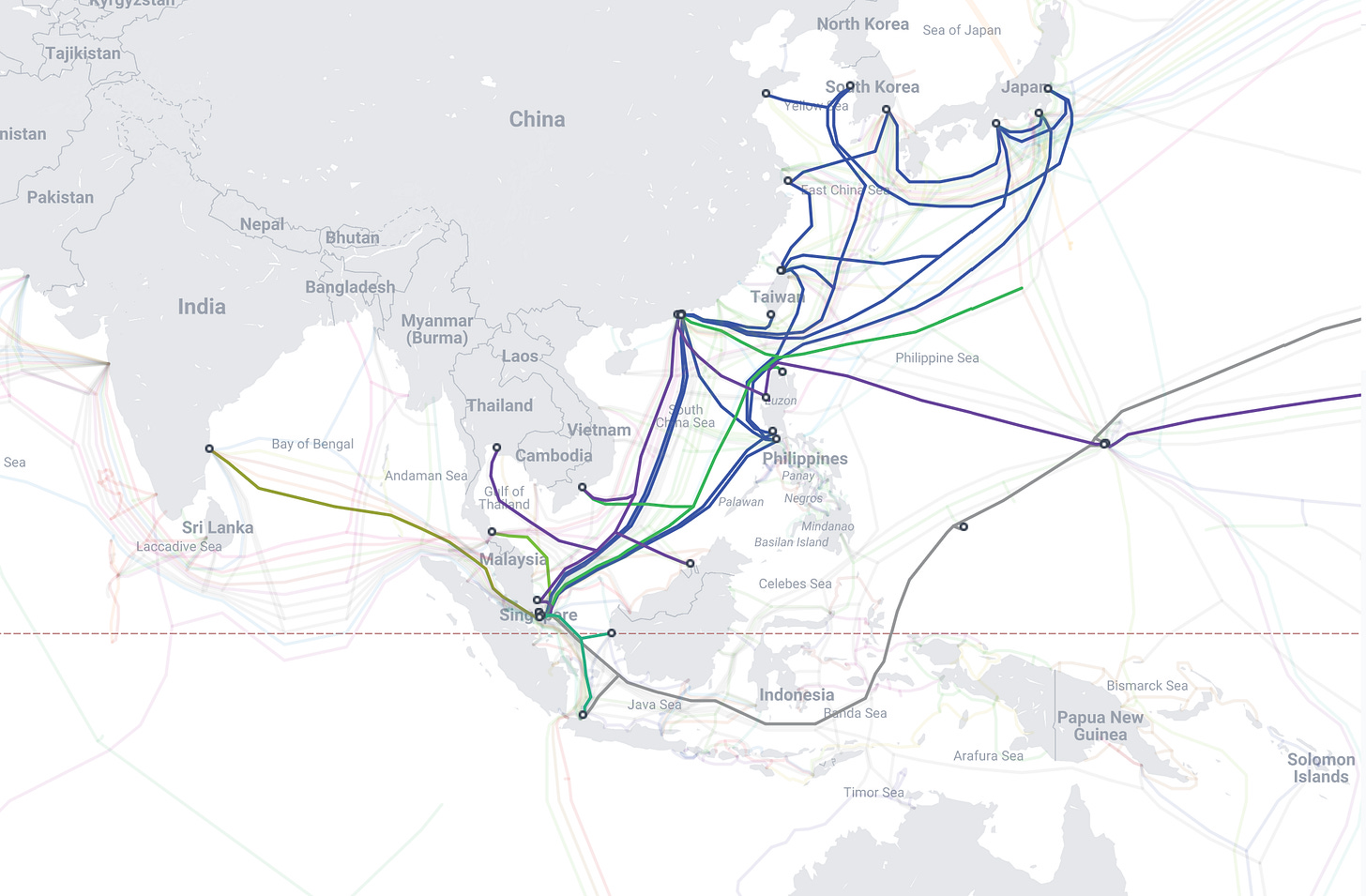

Global Connectivity: Singapore is a node to 26 submarine cables landing, connecting Europe, Asia and Australasia. See map here.

Fiber broadband penetration has reached 99%, with ultra-high-speed broadband access available across the majority of homes.

Singapore is also home to 85 data centers from 41 providers, 6,933,008 sqft (122 football fields) and 1 GW (list here). For context: South Korea has 29 data centers and 1.3GW as of 2023 although an additional 1.9GW is projected to be supplied over the next four years.

Smart estate management for public housing: The HDB Smart Hub initiative connects approximately 1,000 sensors across various estates. These sensors monitor environmental conditions, energy usage, and maintenance needs, providing real-time data to enhance estate management, optimize energy consumption, enable predictive maintenance (on elevators for example) and improve residents’ quality of life.

Open Government Data: Singapore government has released about 3900+ datasets from 71 agencies with over 95,000 data series on economic and socio-demographic domains; including realtime weather and pollution, transportation, parking, health, education, etc.

Digital ID: Singpass provides access to over 2,700 services across 800 government agencies and businesses; it’s a form of Single Sign On service issued by the government. It handles over 41 million transactions every month by 5 million users. Myinfo is a service that businesses can use to access government verified personal data, with the consent of the end user. It enables users to pre-fill forms with their personal data (e.g., NRIC number, address, contact details, CPF contributions, housing status), saving time on repetitive data entry for various services; such for bank account creation and onboarding or to access government services. Since data is retrieved from trusted government sources (e.g., Inland Revenue Authority, CPF Board, Ministry of Manpower), it ensures accuracy and reduces the risk of errors in applications. As of 2023, over 4.5 million users have registered with MyInfo, accounting for a significant portion of Singapore’s population. Businesses that use MyInfo have reported:

An 80% reduction in transaction time for digital transactions

A 20% improvement in digital transaction completion

A 15% increase in approvals due to better data quality

Data Privacy: Singapore’s Personal Data Protection Act (PDPA), enacted in 2012, governs the collection, use, disclosure, and protection of personal data in Singapore. It aims to balance individuals’ rights to privacy with the need for organizations to collect and use data for legitimate business purposes. Key elements include obtaining consent before collecting personal data, ensuring the data is accurate, using it only for the stated purposes, and securing it from unauthorized access or breaches. The PDPA also provides individuals with the right to access and correct their data. The Personal Data Protection Commission (PDPC) oversees compliance and enforcement of the Act, ensuring accountability and trust in Singapore’s data-driven economy. More information at PDPC website.

Cyber Security Policies: In response to the SingHealth cyberattack in 2018, which compromised the personal data of 1.5 million individuals, Singapore launched a comprehensive review of its cybersecurity measures. This led to stricter regulations and protocols for safeguarding sensitive data in healthcare and other sectors. The Cybersecurity Act: enacted in 2018, provides a legal framework to strengthen cybersecurity and protect critical information infrastructure (CII) across key sectors. The Act focuses on safeguarding essential services that are vital to national security, economy, and public health.

The above digital services are illustration of Singapore’s execution of its digital roadmap across all aspects of society, economy, government and security.

From the above, it’s quite obvious that Singapore goes beyond the idea of what a Smart City is. Many policies and initiatives are enacted in fact at national level and other cities around the world do not have the power, control and jurisdiction to enact such initiatives. That’s part of what makes Singapore unique as a Smart Nation; in strategy and in execution. But there is more…

Could other cities adopt a similar approach and see the same benefits?

Why does the Singapore model does not replicate well elsewhere?

Singapore’s Unique Imperative as a Nation

It’s important to remind ourselves that Singapore’s original and only foundational asset is its location. Nothing else. Little space, no resources, limited drinkable water, no land for agriculture.

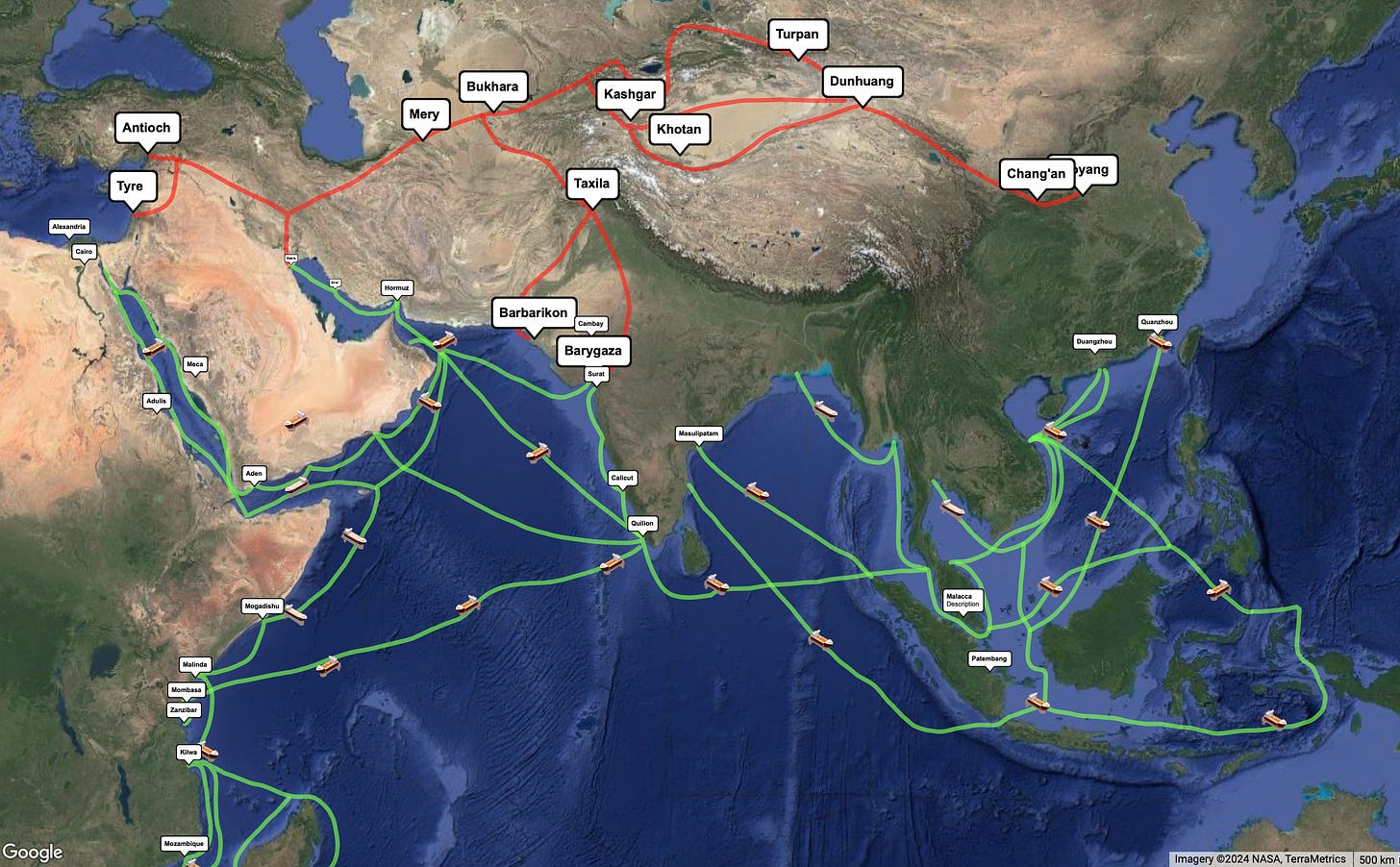

Singapore has been used as a trade hub on the routes between Europe and Asia since its founding in 1819 by Sir Stamford Raffles. Raffles established Singapore as a free port for the British East India Company, strategically located along the Strait of Malacca, a key maritime route linking Europe and Asia. This location made Singapore an ideal hub for global trade, allowing ships to stop for refueling, resupplying, and trading goods without heavy taxes or restrictions. See the map of the Silk Road below.

Contrary to other neighbouring countries like Indonesia, the area is not exposed to either typhoon or earthquakes which makes it literally and figuratively a safe harbour.

The geographical constraints and the lack of natural resources, compel Singapore to innovate out of necessity. This urgency shaped policies that prioritize long-term sustainability, resilience, and economic diversification, setting it apart from other cities

Unlike other countries Singapore had to manufacture its unfair advantage to compete regionally and on the world stage.

Space scarcity

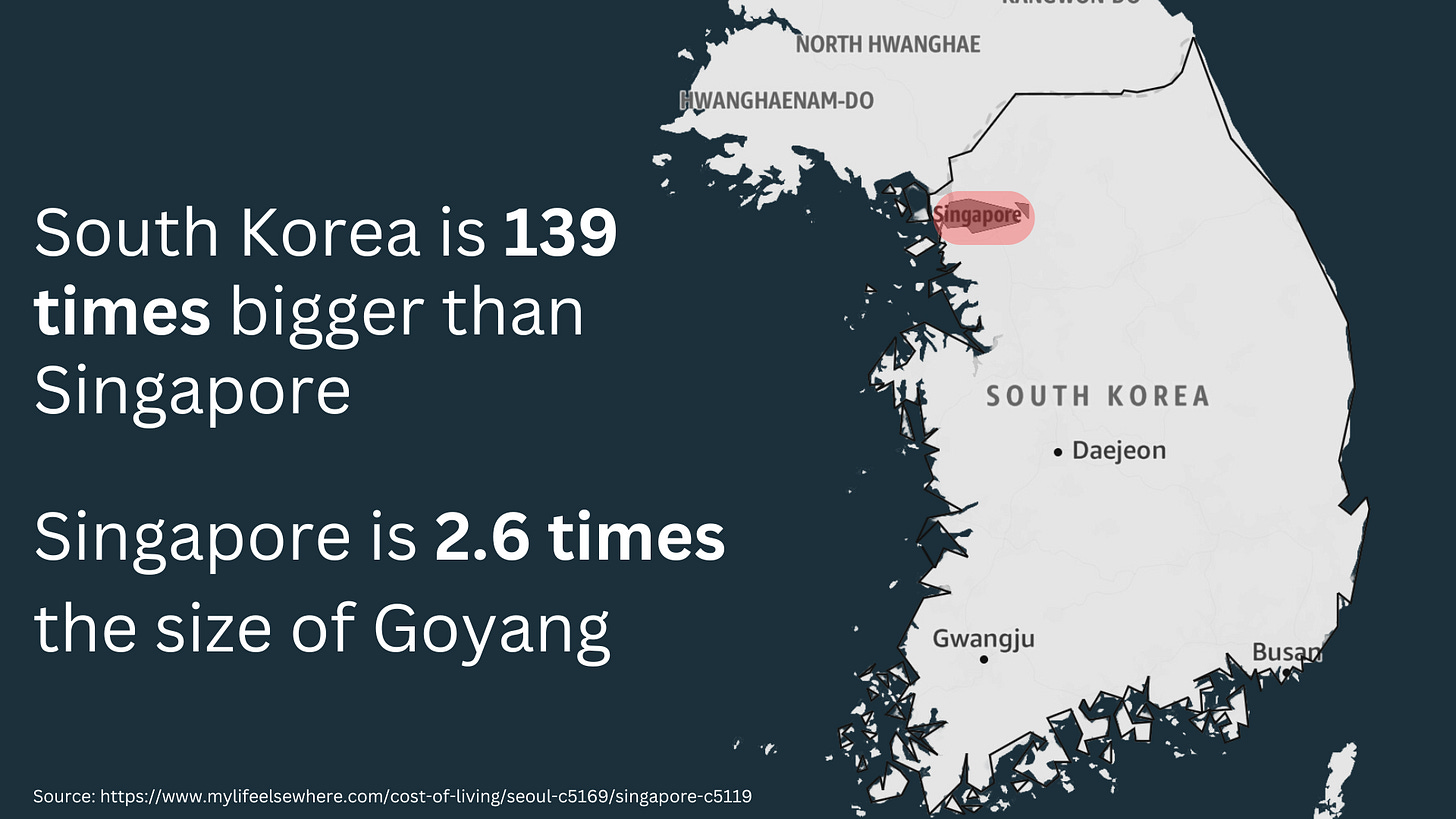

For context, South Korea is 139 times bigger than Singapore; and Singapore is only 2.6 times bigger than the city of Goyang. Singapore is home to $6m people while Seoul greater area alone has $10m inhabitants.

Approximately 25% of Singapore’s total land area is reclaimed. Over the last decades, Singapore has significantly expanded its land area through reclamation projects, turning sea areas into usable land to support its growing population, industrial needs, and urban development. The country’s original land area was around 580 square kilometers, but land reclamation has increased it to over 720 square kilometers.

Water Scarcity

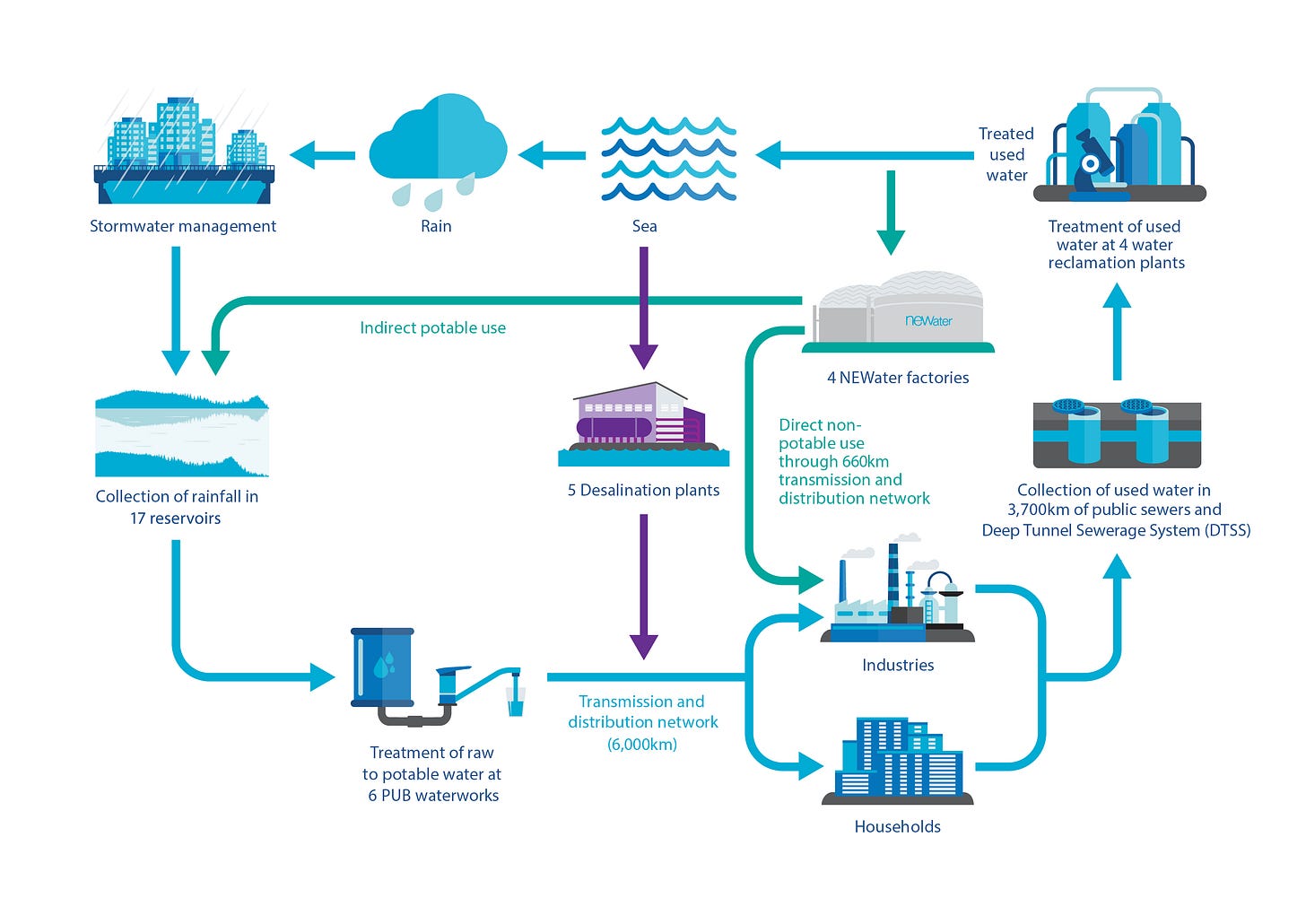

Singapore derives its water supply from four key sources, known as the Four National Taps:

Local catchment water: Two-thirds of Singapore’s land area serves as a water catchment, collecting rainwater through a network of drains, canals, rivers, and stormwater management systems. Rainwater collected from local catchments contributes about 20-30% of Singapore’s total water demand. The aim is to increase the catchment area to 90% by 2060. Singapore has 17 reservoirs that store rainwater. Singapore has an extensive drainage network of more than 8,000 km of rivers, drains, and canals to direct rainwater to the reservoirs.

Imported water (primarily from Malaysia under a long-term agreement). Under the 1962 Water Agreement, Singapore is entitled to draw up to 250 million gallons of water per day from the Johor River in Malaysia. This agreement is set to expire in 2061.

NEWater (highly treated reclaimed water): NEWater currently meets up to 40% of Singapore’s total water demand. This highly treated reclaimed water is used for industrial purposes and can be blended into reservoirs for drinking water, showcasing Singapore’s innovation in water recycling (source).

Desalinated water: As of recent years, 30% of Singapore’s water demand is met through desalination. With an aim to become more water-resilient, Singapore is expanding its desalination capacity to supply up to 30% of its future water needs by 2060.

In summary, Singapore’s Water Loop can be illustrated as per below and consists of:

Collecting every drop of water

Reusing water endlessly

Desalinating seawater

Food Scarcity

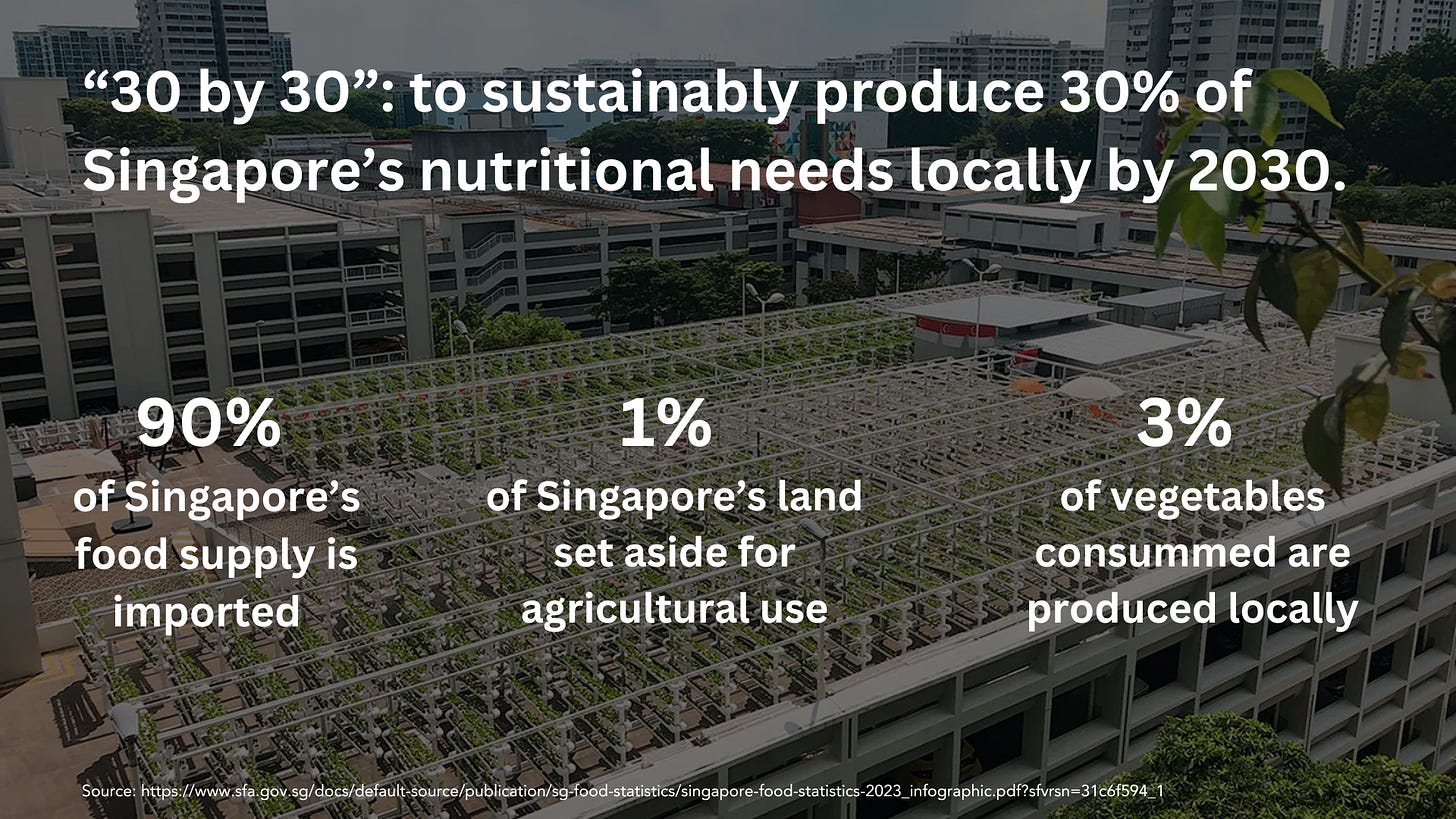

According to the Singapore Food Agency (SFA), Singapore imports more than 90% of its food. Only 1% of its land is used for agricultural use and only 3% of the vegetables consumed are produced locally. Singapore has devised a plan to produce 30% of its nutritional needs locally by 2030: the 30 by 30 plan. It includes a few strategies including highly optimized farming and multi-storey LED lighting and recirculating aquaculture systems to produce 10 to 15 times more than traditional farms.

Progress Through Innovation: Manufacturing Growth

With the serious constrains above, Singapore has no choice but to consciously and decisively manufacture growth using a combination of sector specific investments as well as targeted initiatives to make Singapore a destination in the region.

Sector Specific Investments

Singapore’s focus has shifted over time. Each wave of investment has built on Singapore’s strategic assets—location, governance, and human capital—creating an adaptable, innovation-driven economy.

Through these focused investments, Singapore has evolved from a manufacturing base to a sophisticated, diversified economy with a global influence in high-tech and future-ready sectors.

Here is a quick recap:

Industrialization (1960s-1980s): Laid foundations in manufacturing, especially electronics and petrochemicals, attracting MNCs to drive growth and employment (and this “Chips War” continues as tension between US and China grow and offer opportunities to SEA countries to rise)

Biomedical Sciences (1990s-2000s): Shifted to high-value industries like biotech and pharmaceuticals, establishing Biopolis and attracting major global players.

Financial Services & Fintech (2000s-2010s): Became a global financial hub, promoting fintech innovation with regulatory support and events like the Singapore Fintech Festival.

Digital Economy (2010s-2020s): Focused on tech infrastructure and AI, launching Smart Nation and National AI Strategy, drawing major tech firms and advancing digital innovation.

Advanced Manufacturing & Sustainability (2020s and Beyond): Invested in AI, robotics, and green tech, emphasizing resilience and sustainability for a future-ready economy. There have been 193 newly funded AI companies from 2013 to 2023 with a total of US$6.3b in AI private investment and $1 billion government investment in AI as part of the National AI Strategy 2.0. Singapore now the second most automated country in the world, behind South Korea. According to the World Robotics 2023 report, Singapore has 730 robots per 10,000 employees, an average increase of 27% yearly since 2015, far ahead of the average global robot density of 151 robots per 10,000 employees (source).

Its pro-business environment with low taxes, clear regulations, and a reputation for political stability, Singapore attracts global businesses to set up regional headquarters. Multinational corporations view Singapore as a gateway to Asia, and the government actively supports innovation with initiatives like research grants, startup incubators, and innovation hubs:

SAP Labs Singapore: Established in March 2022, this digital innovation hub focuses on artificial intelligence (AI), machine learning, and next-generation digital engineering. It aims to employ over 500 professionals by 2025 (SAP News).

Nestlé R&D Center: Celebrated its 40th anniversary in 2021, Nestlé’s R&D center in Singapore develops innovative food and beverage products tailored to Southeast Asian markets, emphasizing nutrition and sustainability (Nestlé).

Hyundai Motor Group Innovation Center: Opened in November 2023, this facility serves as a smart urban mobility hub, focusing on human-centric manufacturing, AI, and robotics to transform production and customer experience (Hyundai News).

Panasonic R&D Center Singapore: Established in 1990, this center specializes in developing private communication applications for enterprise use and public safety, aiming to transform technologies into real-world applications (Panasonic Research).

BSI Innovation Lab: Launched in January 2022, this lab collaborates with startups to enhance audit processes and compliance through advanced technologies, offering a creative environment for digital innovations (BSI Group).

Google Cloud AI Research Hub: Focuses on advancing AI and machine learning for natural language processing and healthcare. In August 2022, the Smart Nation and Digital Government Group (SNDGG) partnered with Google Cloud to enhance AI innovation in Singapore (Smart Nation).

Microsoft Asia-Pacific Technology Center: Concentrates on cloud computing, AI, and cybersecurity innovations. In November 2019, Microsoft launched its first Experience Center worldwide for Asia Pacific in Singapore, aiming to empower a new global innovation engine (Microsoft News).

Visa Innovation Center: Develops digital payment and FinTech solutions, collaborating with regional startups. Visa’s Singapore Innovation Center serves as a hub for partners to collaborate, design, and develop new digital commerce experiences (Visa).

IBM Research Singapore: Specializes in AI, blockchain, and quantum computing for urban and industrial applications. In August 2024, IBM and the National University of Singapore (NUS) announced plans to establish a new AI research and innovation center (The Straits Times).

Cisco Innovation Center: Drives IoT, cybersecurity, and smart city technologies. In February 2019, Cisco launched its first Southeast Asian Co-Innovation Center and Cybersecurity Center of Excellence in Singapore (The Straits Times).

Rolls-Royce Advanced Technology Centre: Innovates in aerospace, focusing on sustainable aviation and advanced manufacturing. The center collaborates with Singaporean institutions to advance aerospace technology.

Procter & Gamble (P&G) Singapore Innovation Center: Focuses on consumer product innovation and sustainable packaging. P&G’s Singapore Innovation Center works on developing new products and technologies for global markets.

Johnson & Johnson Asia-Pacific Innovation Hub: Advances medical technology, digital health, and precision medicine. The hub collaborates with regional partners to drive healthcare innovations.

Furthermore, Singapore is considered one of the world's leading startup hubs: Singapore is ranked as the seventh best global startup ecosystem, and the top startup ecosystem in Asia. .

Singapore's startup ecosystem created $144 billion in economic impact in 2023, and is home to 20 unicorns as of 2024, many of which operate in Southeast Asia such as Grab, Sea Limited, Nium, and YouTrip

Making Singapore a destination

Singapore has become a premier destination for some of the biggest global events, a strategic outcome of its investments in world-class infrastructure, connectivity, and supportive regulatory frameworks. This positioning reflects the city-state’s commitment to being a hub for international business, culture, and tourism in the Asia-Pacific region.

• Singapore FinTech Festival: Launched in 2016, the Singapore FinTech Festival (SFF) quickly became the world’s largest gathering for the fintech community, reflecting Singapore’s position as a leading financial hub. SFF has grown from 13,000 attendees in 2016 to a record-breaking 66,000 participants from over 100 countries in 2023 (Singapore FinTech Festival). It showcases cutting-edge fintech innovations, attracts global leaders in finance and technology, and fosters international partnerships, establishing Singapore as a central player in the global fintech ecosystem.

• Singapore Airshow: Held biennially, the Singapore Airshow is Asia’s largest aerospace and defense event, attracting global defense and aviation industry leaders. It serves as a platform for major deals, innovations, and discussions on the future of aviation and defense technology. The event reinforces Singapore’s role in aerospace and defense, bringing together government, military, and industry players from around the world (Singapore Airshow).

• Singapore Grand Prix: The Singapore Grand Prix, the first Formula 1 night race, is a standout event that combines world-class motorsport with a vibrant entertainment lineup. It draws around 300,000 spectators yearly and showcases Singapore’s infrastructure, nightlife, and hospitality (Singapore Grand Prix). The Grand Prix has cemented Singapore’s position in the global sporting landscape, highlighting its ability to deliver large-scale events that boost tourism and international visibility.

• Taylor Swift’s Concerts (2024): Singapore’s cultural appeal and concert-ready venues were highlighted when Taylor Swift’s six sold-out shows in March 2024 attracted over 300,000 fans (Straits Times coverage). Worth noting:

“Singapore Government offered subsidies of up to US$3 million (S$4 million) for each concert – in exchange for Swift agreeing not to perform elsewhere in South-east Asia during The Eras Tour.“ (The Straits Times).

This demonstrates Singapore going above and beyond to host large-scale international events, bolstering its reputation as a major entertainment destination in Asia. These high-profile concerts benefit the local economy, attracting tourists and driving revenue for hotels, restaurants, and retailers.

These flagship events underscore Singapore’s strategy to remain at the center of regional and global activity, leveraging its unique blend of business-friendly policies, efficient infrastructure, and vibrant culture to attract international gatherings across finance, entertainment, and industry.

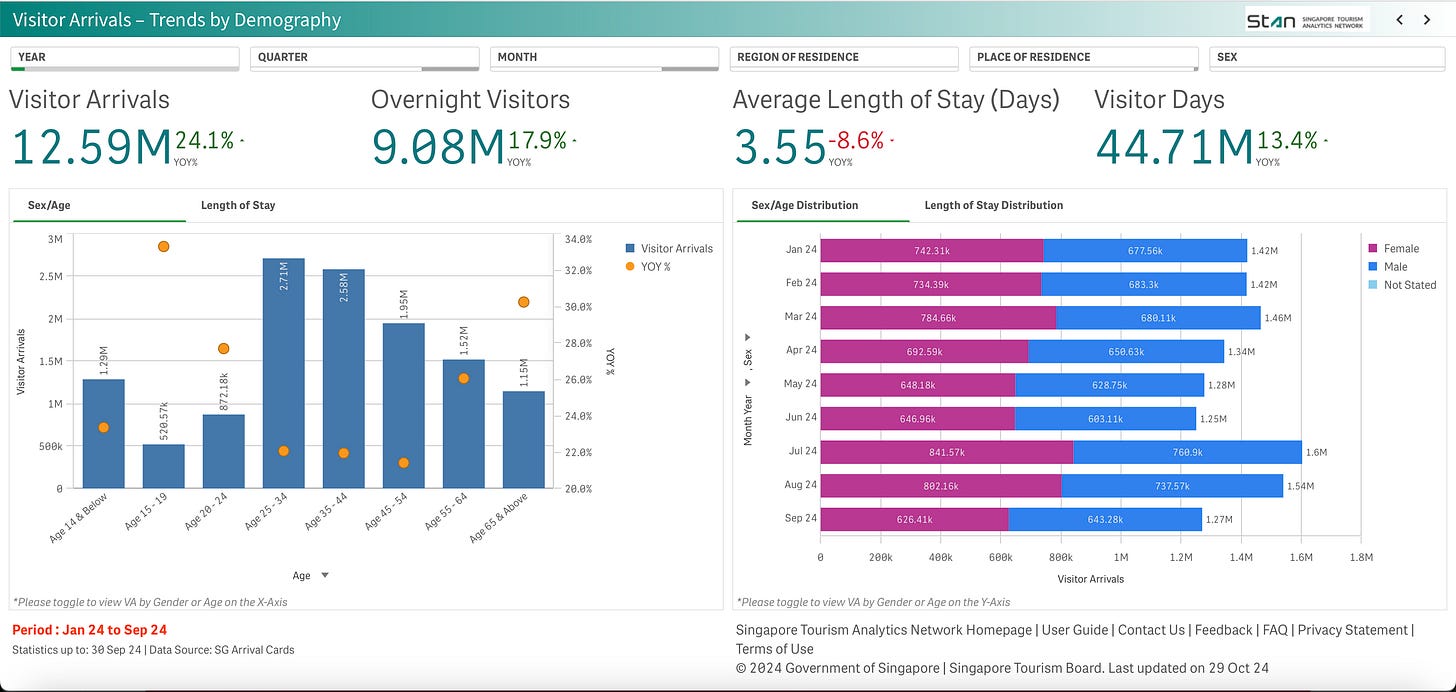

Going further: Explore Singapore Tourism Board dashboards here: https://stan.stb.gov.sg/content/stan/en/tourism-statistics.html

Now we have seen what makes Singapore unique as a city-nation; and the underlying force for its relentless search for long term sustainable growth: necessity.

As we inventory all the great undeniable achievements, there are also important learnings to draw from the Singapore journey. What’s the price to pay?

The Price Of Progress: unseen challenges, untold gaps and unequal benefits

This unprecedented growth has also raised concerns like the digital divide, data privacy, and freedom of speech; and how to balance technological progress while maintaining social equity and individual rights.

Wealth and progress has not benefited everyone the same way; and ubiquitous technology and mass data collection has raised concerns on data privacy and freedom of speech amongst its citizens.

Wealth inequality (measured by the Gini Index) in Singapore surpasses other APAC nations. Inequality rose by 22.9% between 2008-2023. Wealth inequality in Singapore has surged by almost 30% from 2008 to 2023, surpassing that of Asia-Pacific neighbours, including Indonesia, Hong Kong, Taiwan, and Mainland China. Between 2008 and 2023, Singapore recorded an average wealth growth of 116%. The average wealth of adults in Singapore is US$397,708 (source by SBR).

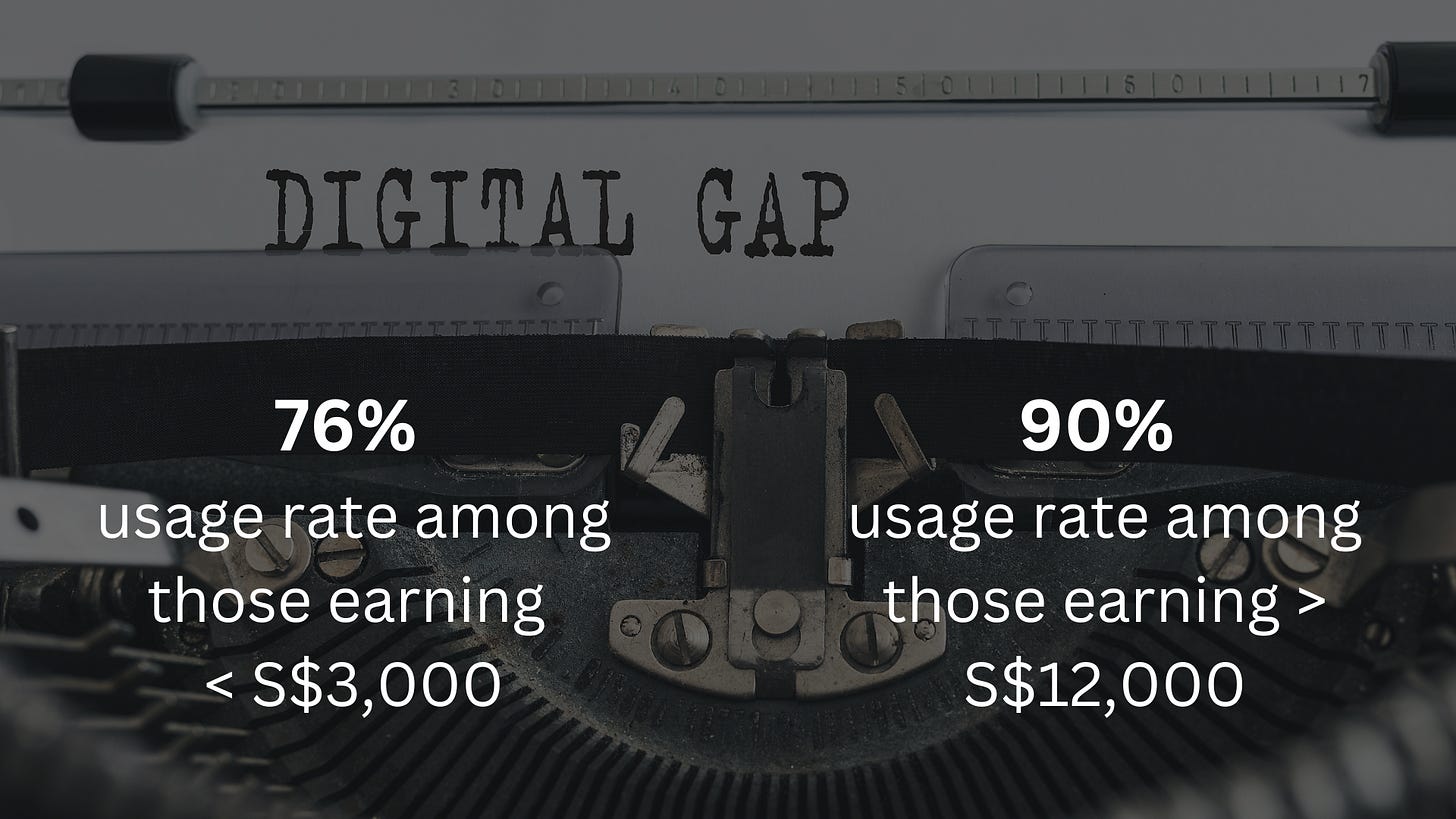

Singapore's digital divide - in terms of income - is wider than that of its global peers. Only 42% of Singapore's lowest-income households (below the 10th percentile) have their needs met by online government services, despite having the lowest expectations, a 2021 report by the Boston Consulting Group (BCG) found. Only 69% of the lower-income group noted a belief that personal information would not be used for any purpose other than for which it was collected, compared with 84% for the highest-income group. This reveals a clear gap in relative trust of digital government services between these two income groups.

According to BCG report, “If Singapore is to achieve this goal, it will need to recognize, and address, the two key areas of digital divide - in income and in age: ensure appropriate provision of desired digital government services while promoting the benefits and reinforcing trust and transparency in management of data submitted to digital government services; while addressing questions of user-friendly service provision raised by the youngest age groups, while at the same time working to tackle the parallel concerns of real-time support, assistance and transparency raised by the oldest demographic.”

Trust in digital government services: revelations around how data collected under Singapore's TraceTogether programme to track Covid-19 contacts may be used for criminal cases too. This comes despite previous reassurances around the siloed use of data and created some angst amongst citizens.

On Data Privacy there a few areas of concern:

Surveillance Concerns: Mass data collection through sensors, cameras, and IoT devices leads to fears of over-surveillance and loss of privacy, particularly in public spaces.

Centralization of Data: Systems like MyInfo and National Digital Identity (NDI) centralize sensitive personal data, raising concerns over data security and citizen control.

Data Misuse Risks: Increased data sharing between government and private sector entities raises the potential for data misuse, including unauthorized profiling or commercial exploitation.

Limited Citizen Control: Citizens have limited control over how their data is collected and used, particularly in public surveillance systems and shared data platforms.

Erosion of Privacy: The scale and scope of data collection can contribute to a sense of diminished privacy, particularly with technologies like facial recognition and real-time monitoring.

Cybersecurity Vulnerabilities: The integration of various smart city systems increases the risk of large-scale cyberattacks, as seen in past breaches like the SingHealth incident. For illustration, here are some of the most significant data breaches affecting Singaporean companies or individuals:

SingHealth Data Breach (2018): Hackers accessed the outpatient records of 1.5 million patients, including the Prime Minister; led to stricter cybersecurity policies in healthcare (GovTech Singapore, Straits Times).

RedDoorz Data Breach (2020): Personal data of 5.9 million users stolen and sold online, raising concerns about data security for user information (Channel News Asia, TechCrunch).

Sequoia Capital Data Breach (2021): Sensitive data of investors and startups exposed, impacting entities across Singapore and globally (Business Times, TechCrunch).

Singtel Data Breach (2021): Compromise of 129,000 customers’ personal data and sensitive corporate information due to Accellion’s file-sharing system vulnerability (Singtel News Release, ZDNet).

Securities Investors Association (Singapore) (SIAS) Data Breach (2021): Unauthorized access exposed personal details of 70,000 members, raising data protection concerns in member-based organizations (Straits Times).

StarHub Data Breach (2022): Compromised data of around 57,000 individuals, including information from third-party providers, highlighting third-party risk management (StarHub Announcement, Straits Times).

Reliance on low cost labor increases disparities: tightly controlled and managed immigration policies has kept on inflow of both low cost labor and highly qualified professionals coming in and out.

Unchallenged political continuity has been a serious advantage to the execution of it’s long term strategy; unlike most democracies that experience alternate governments from various sides, undoing what the previous one had done, and too focus on the short term election cycles instead of the long term plans. However the model also has limited democratic freedoms seen in other systems. Strict regulations on free speech, media, and public assembly curb dissent and restrict open debate, while laws like Protection from Online Falsehoods and Manipulation Act (POFMA) regulate online content, often discouraging critical viewpoints. It’s not that people don’t have opinions—believe me, they do! But this environment results in a narrower scope for public discourse and constrained civil society activities, reducing avenues for citizens to voice alternative perspectives (eg. death penalty, inequalities, human rights,…).

A few other side-effects and limitations of Singapore’s centralized governance and top-down execution:

Stimulating innovation via grants, subsidies and tax credits shows limitations in scaling and creating long lasting impact as Companies tends to stop once credits are exhausted.

The startup investment landscape is evolving but still quite immature, many Venture Capital firms are made of ex-bankers who have a limited understanding of what building a company really means (I was even asked by a few to create discounted cashflow projections over 10 years for my startup at pre-seed stage while fund raising…)

Many local talents tend to either work for the government or for a few rare ones, leave Singapore. Indeed very few have appetitive to leave Singapore: they feel they have too much to lose (safety, comfort, salary, low tax, pension, etc).

Top-down policies may make people feel unheard: the risk is a disconnect between what the government does and what the people really want and need.

Singapore’s stock market at ‘rock bottom’: companies valuation on SGX and the low number of IPOs and shrinking listing size might be worrying.

Finally, some other areas have been surprisingly lagging like banning plastic bags in supermarket or single use plastic containers for takeaway food, or the adoption of Electric Vehicles (Tesla Model S appeared in Hong Kong in 2014 while the first Tesla in Singapore was Model 3 in 2021).

Now we have seen how Singapore’s growth is nothing else but Intentional and part of a thought-through plan consistently executed over a long period of time. It has created side effects and raised concerns; although the vast majority of the population is satisfied by the policies and outcomes they have benefited from to date. In fact a 2024 poll suggests that Singaporeans feel their country is more democratic now than a decade ago, and show support for the system.

Final Thoughts

Singapore has achieved incredible growth and prosperity for its people, out of raw necessity to survive as a country.

The generation who built Singapore was fighting for its survival as a nation.

As the new generation now rips the benefits of the hard work and sacrifices of its seniors and looks ahead; it will have to find its own way to stay relevant, resilient and self-sustaining.

The new leadership will need tackle both domestic and international challenges; to name a few:

Domestic Challenges for Singapore:

Aging Population: Singapore’s low fertility rate and increasing life expectancy are leading to a rapidly aging population. This puts pressure on healthcare, social services, and the workforce as a smaller younger generation supports a growing elderly population. (Source:Channel News Asia)

Rising Cost of Living and Income Inequality: The cost of living, particularly in housing, healthcare, and education, is increasing, while income inequality is growing. Social unrest and reduced standard of living for lower- and middle-income families, with potential consequences for social cohesion. (Source: The Straits Times)

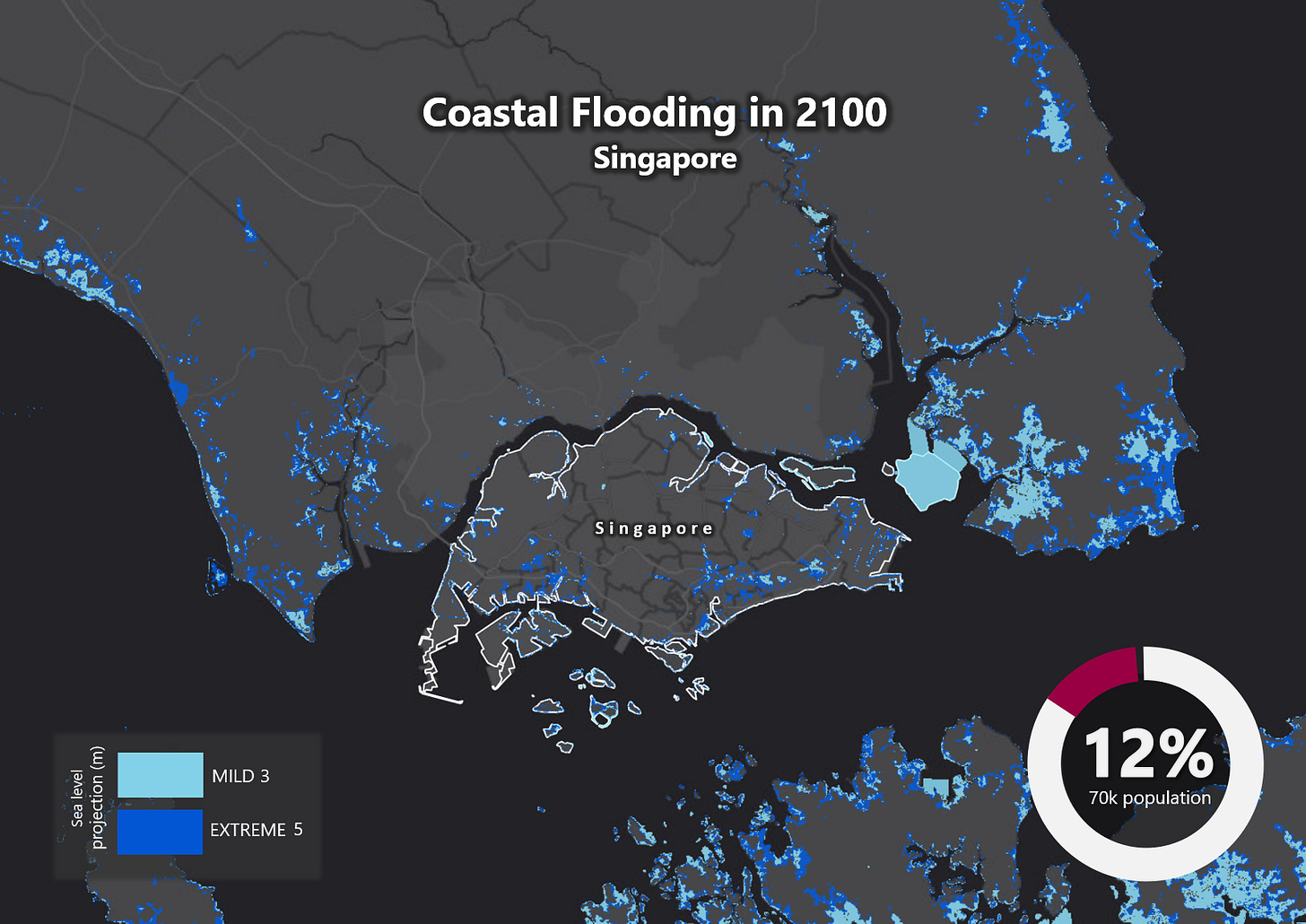

Rising Sea Levels. Rising sea levels threaten Singapore’s coastal infrastructure due to global warming. Increased flooding, land loss, and potential damage to critical infrastructure such as airports and ports. (Source: National Climate Change Secretariat)

(Source: https://earth.org/data_visualization/sea-level-rise-by-the-end-of-the-century-singapore/)

Increased Heat: Rising temperatures, worsened by the urban heat island effect, are leading to higher risks of heat stress and energy demands. Greater public health risks, especially for vulnerable populations, and increased energy consumption for cooling. (Source: The Straits Times)

Regional/International Challenges for Singapore:

Geopolitical Tensions in Southeast Asia: Territorial disputes in the South China Sea and U.S.-China rivalry create an unstable regional environment. Potential risks to trade routes, diplomacy, and economic stability, requiring careful balancing of relationships. (Source: The Diplomat)

Global Economic Uncertainty and Trade Dependencies: Singapore’s trade-dependent economy is vulnerable to global economic shifts and supply chain disruptions. Economic downturns and protectionist policies may affect growth, pushing Singapore to diversify its economy. (Source: Channel News Asia)

Technological Disruption and Global Competition. The rise of AI and other disruptive technologies poses both opportunities and competitive threats from other tech hubs. Singapore must invest in innovation, talent development, and infrastructure to remain competitive globally. (Source: The Business Times)

As we aim to make our cities better to live, work and play we should focus on:

• Inclusivity: Ensuring technological advances benefit everyone and unite, not divide, communities.

• Human-Centric Design: Technology should serve people, not the other way around.

• Ethical Data Use: As cities rely more on data, balancing its use for public good with individual privacy rights is critical. Transparency and citizen control over data are essential to maintaining trust.

• Sustainability: Innovation must be balanced with environmental and social sustainability to build resilient cities.

Finally, as we reflect on how to design our cities to enable our communities to thrive, I’d like to leave you with a few open questions to consider:

• When is technology not the solution?

• When do human connections should prevail over data?

• When should the government step aside and leave the private sector and entrepreneurs take the lead to shape the future?

• How can we foster an innovation mindset while overcoming deeply ingrained cultural hierarchies and risk aversion?

What do you think?