Investment Decisions: Creating A Competitive Edge Using Big Data & Machine Intelligence

In 1970, Eugene Fama comes up with the Efficient-Market Hypothesis that says that stocks always trade at their fair value because their…

In 1970, Eugene Fama comes up with the Efficient-Market Hypothesis that says that stocks always trade at their fair value because their price reflects all the information available about a company stock at a given point in time. Hard to believe in the era of Big Data…

In 1973 the Economist Burtan Malkiel said: “a blindfolded monkey throwing darts at the stock listings” could do as well as a professional money manager; which would tend to prove the hypothesis above. And so, interestingly, on October 7th 1998 the Wall Street Journal launched the Dartboard Contest: everyday for 100 days, WSJ staffer acted as the monkeys by throwing darts at a stock table; and investment experts picked the stocks. 61% of the pros did better than the staffers; 51% only beat the Dow Jones Industrial Average index (excluding tax and transaction costs). In terms of returns, the pros average gain was 10.8% versus 4.5% for the darts and 6.8% for the DJIA. In short, a handful of pros did quite well but overall it does look like an investor is better off going the passive investing route.

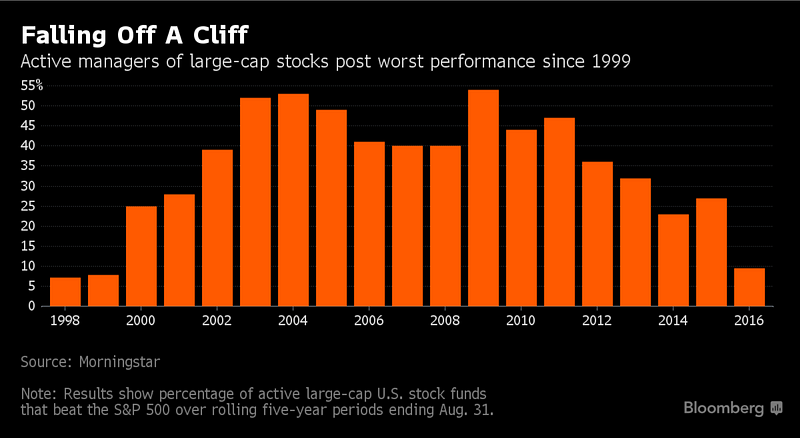

In fact, the performance of Active Managers of large-cap funds over a five year rolling period has been going down for the past 7 years: when 54% of them beat the S&P500 back in 2009, they were less than 10% in 2016. In other words, 90% of the active managers generate lower returns than a passive investment on the S&P500 index.

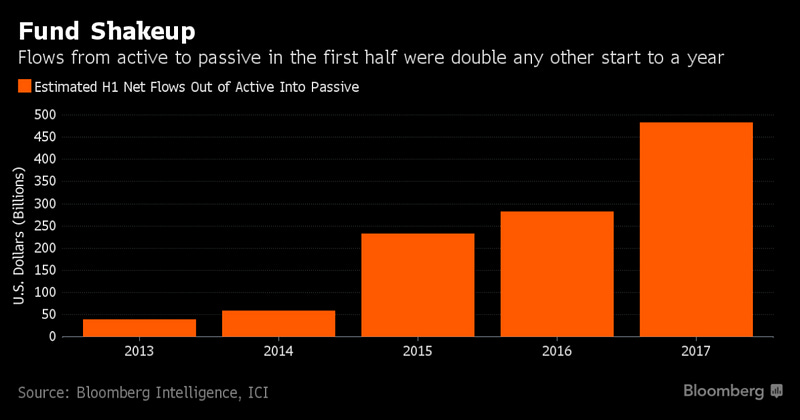

The result: an outflow of close to 500 Billions USD in the first half of 2017 alone (double from 2016) from active to passive investments.

All? No, Warren Buffet’s Bershire company has shown extraordinary returns by beating the S&P500 37 years over 43 year period; with compounded annual gains of 21.1% (after tax!) vs. 10.3% for the S&P500 over the same period.

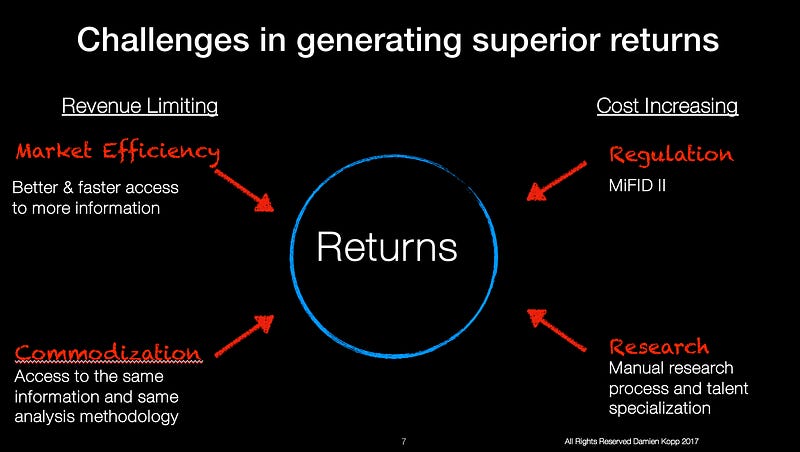

So, why is it getting so difficult to generate higher returns?

According to Quinlan & Associates in their latest report; there are revenue limiting factors and cost increasing factors.

Revenue-limiting factors:

Market efficiency: better and faster access to information makes it harder to have an edge;

Commodization: access to the same information and similar analysis and modeling methodology give similar results, which prevents differentiation.

On the other hand, the cost increasing factors:

Regulation, in particular the imminent MiFID II in January 2018. Mifid II is shortform for the second Markets in Financial Instruments Directive from European regulators. It builds on regulation brought in during 2007 that sought to make investing more transparent for both retail and institutional investors and which standardised regulatory disclosures required for particular markets. In plain English that means everyone had to be clearer about costs, charges and fees and explain them in a standard way, up front: which includes separating the cost of research and the cost trades execution.

Research is very labor intensive, requires talents and specialization and hardly scalable (more stocks to follow means more people).

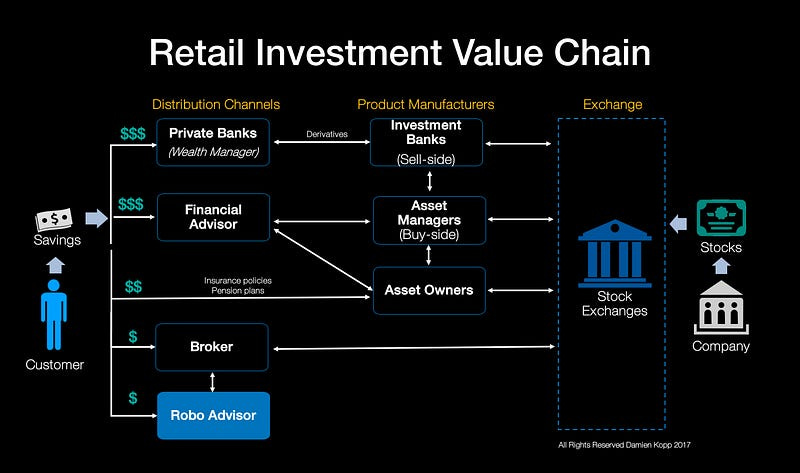

In this context, Wealth Managers and Financial Advisors are facing more challenges to justify their management fees as well as providing holistic and unbiased advice: as most are commission-based and work for financial products manufacturer, they tend to push their own products, even if they are not appropriate for their customers. The diagram below shows the effect of this change of paradigm and how investors redirect their savings to the low costs products.

In short, increasing costs, service commodization and limited revenue opportunities are pushing the investors to rely less and less on intermediaries; that leaves them with a growing void to fill in which new entrants like robo-advisors and other FinTechs are getting into.

In 2015, Goldman Sachs CEO Lloyd Blankfein said "We are a technology company“: today 30% of its headcount is in technology, that's more than 11,000 people.

While the need for differentation is glaring, digital technologies are still lacking and organizations have not transformed yet to capture the full value of the data revolution.

How to create value-generating signals?

As Michael Douglas puts it as Gordon Gekko in Oliver Stone’s movie Wall Street: “The most valuable commodity I know of is information”. Creating value-generating signals involve:

Robotics via intelligent workflow automation

Data source diversification with alternative datasets

Investments decision-making process mapping

The sum of these tools is what we would call Quantamental: an integrated data driven approach throughout the investing process leveraging quantitative insights and fundamental research.

1. Robotics via intelligent workflow automation

Automation is necessary for cost optimization, but we are now passed the point of simple task automation and moving to intelligent automation.

For example, being "intelligent" in the context of a marketing sales process of an investment bank includes being relevant, timely and actionable.

Providing curated research content, personalized at the organization, department or individual level; at the right time, in the right format using the right medium can help significantly the sales teams to act and provide superior insights to their clients more efficiently.

2. Data source diversification with alternative datasets

As discussed above, content and speed can help create Information asymmetry. Alternative data sources such as satellite images showing ports activity by tracking container ships coming in and out; drones monitoring warehouses and factories to count the number of trucks coming in and out are key alternate indicators that can help predict variations of a company’s future cashflows.

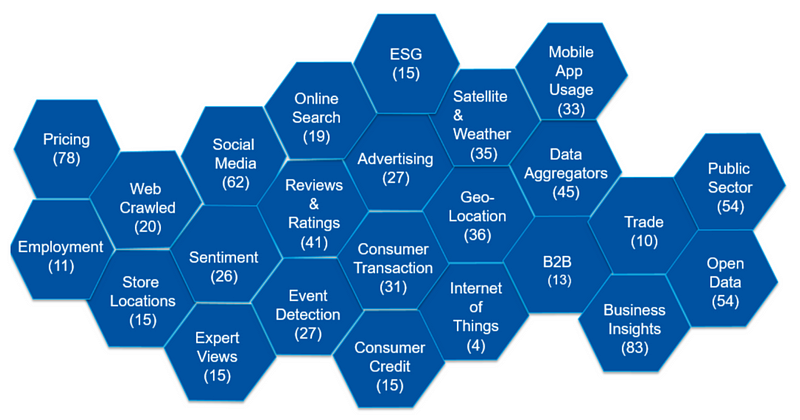

Eagle Alpha, an alternate data aggregator, has identified 515 datasets across 24 categories:

Similarly, Quinlan Associates, cites in their latest report on Alternate Data, that Under Armour deceiving performance in Q2 2017 could be anticipated based on the job listing and the cloths price changes on their website as well as the latest ratings of their CEO on Glassdoor.

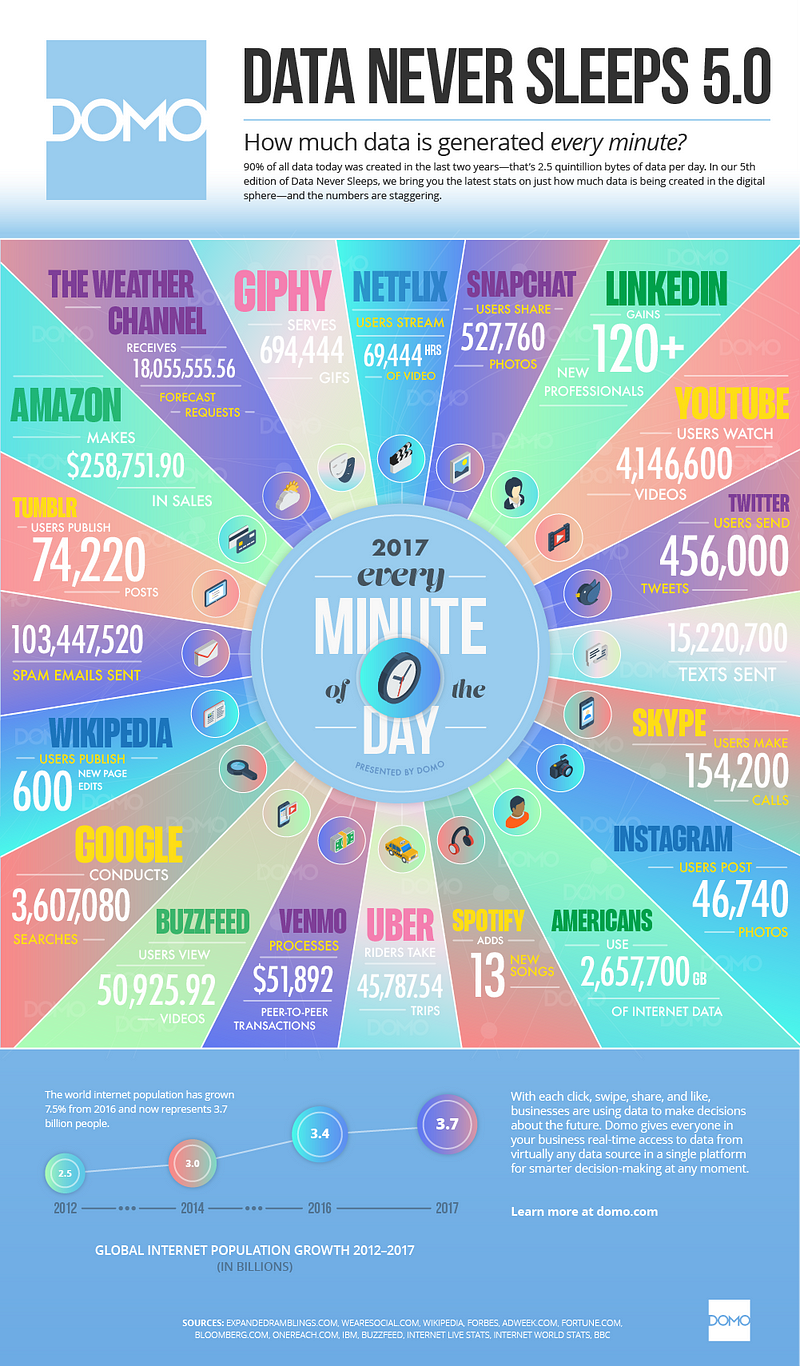

DOMO's Data Never Sleeps visualization below gives a compelling view of Big Data'’ famous 4Vs (Volume, Velocity, Variety, Veracity).

In the investment world: 4,000 brokerage reports are published every day; that's 36,000 pages in 53 languages. Finding an information in 15 years of such reports would be like finding a nugget in an area of the size of a football field.

3. Investments decision-making process mapping

As I mentionned in a previous article: our boldest, brightest and poorest decisions are based on logic and guts.

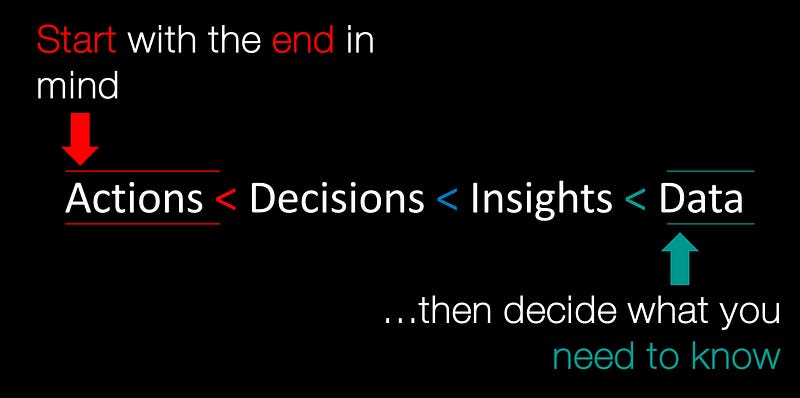

When facing an ocean of data, it's easy to get overwhelmed: hence it becomes imperative for organizations to have a structured process in place to manage the decision value chain: starting with the end in mind is key to move from Data to Insights to Decisions to Actions.

Avoiding the flaws and biases as the information goes up the chain are part of the challenges: data points may be irrelevant, conclusions may flawed, decisions miscommunicated, actions not incentivised properly.

Finally, as information is moving from data to action; it's also getting powered less by technology and more by humanism. Bridging the gap between the two, communicating very complex answers to difficult questions can be a real challenge for everyone involved along the value chain.

Closing Remarks

Differentiation can achieved via better Value Capture or increased Value Creation, or both: Value capture can be achieved cost reduction via intelligent automation while Value creation can be achieved by differentiation via information asymmetry and superior decision making with high intimacy with capital markets.

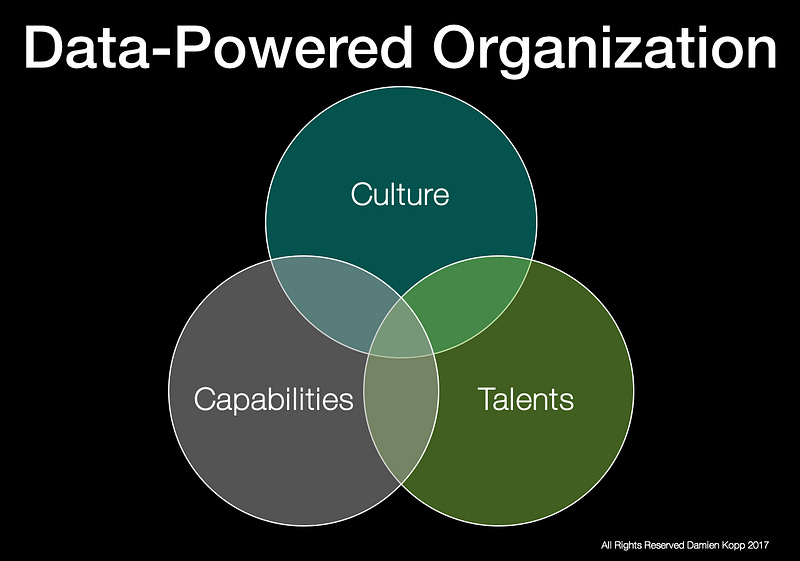

In both cases, it requires transforming the organization into a Data-Powered Organization around 3 pillars: what is being one (capabilities), how things are done (culture) and who is doing it (talents).

Subscribe to my Newsletter for weekly provoking thoughts on tech & innovation

koncentrik.co

Damien P Kopp